In July 2020, our group endorsed the recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD).

Based on the TCFD recommendations, we disclose important information related to climate change as outlined below.

Our group is aware that climate change and other environmental issues are serious business issues. Therefore, the board of directors is responsible for final decision-making and supervision regarding all aspects of our climate change response.

With regard to our management policies and directions related to climate change, the CSR and Sustainability Committee* chaired by an outside director, which functions as an advisory body to the board of directors and meets at least four times a year, compiles recommendations in consideration of climate-related risks and opportunities and reports them to the board of directors. Final decisions are made by the board of directors.

The progress of our response to climate change and other Priority Management Issues is reported to the CSR and Sustainability Committee by the sustainability department, and reviewed and monitored at the Committee. Specific activities such as CO2 reduction are monitored for progress towards the targets and issues to be addressed at the Environmental Committee, which convenes twice a year, in order to achieve continuous improvement. Furthermore, risks associated with climate change are assessed within the context of overall enterprise risk management at the Risk Management Committee, which convenes twice a year.

The CSR and Sustainability Committee has the responsibility of overseeing various specialized committees, including the Environmental Committee and the Risk Management Committee. Each specialized committee monitors whether tasks associated with its specialized field are executed effectively, and the CSR and Sustainability Committee, in turn, supervises the overall effectiveness of these specialized committees. Important information reported, discussed, and decided upon in each specialized committee, such as progress in CO2 reduction and risk assessments, is also shared with the CSR and Sustainability Committee.

Important decisions made by specialized committees are reported to the board of directors through the Management Meeting, which is responsible for deliberating, deciding, and supervising important matters in business operations. The board of directors provides oversight in this regard.

Furthermore, in order for our executives to take the lead in promoting climate change countermeasures, we have included the reduction of CO2 emissions as one of the performance indicators in the performance-based stock compensation system for directors (excluding directors who serve on the audit committee and external directors) and executive officers (excluding executive officers on an employment contract).

We identified a wide range of climate-related risk and opportunity factors across the entire supply chain, from upstream to downstream, with reference to examples shown in the TCFD recommendations, while forecasting social and regulatory trends in the short, medium, and long term.

Among the identified risk factors, we primarily considered the risks associated with the transition to a low-carbon economy under the 2°C scenario and the risks associated with climate-related physical changes that may occur in the case of the 4°C scenario due to unmet global CO2 emissions reduction targets. We classified these risk factors according to the TCFD’s classification guidelines and assessed their business impacts. Specifically, the sustainability department conducted extensive discussions to identify risk factors and developed the assessment of business impacts. Regarding the identified opportunity factors, we classified and examined them according to the TCFD’s classification guidelines, particularly focusing on the “opportunities for business transformation through climate change mitigation and adaptation measures.”

We then discussed and considered the matter with the officer supervising the sustainability department, as well as the members of other related departments, such as the risk management department and the environment department. The compiled climate-related risks and opportunities were reported to and confirmed by the CSR and Sustainability Committee.

< Main scenarios and projections used in the study >

2℃ scenario: IPCC RCP2.6, IEA ETP 2DS, etc.

4℃ scenario: IPCC RCP8.5, IHS Markit Automotive "Mobility and Energy Future" service data, etc.

The three terms used below, “short term,” “medium term” and “long term,” have the following meanings:

Short term: until around 2025 in line with the target year of our medium-term management plan

Medium term: until around 2030 in line with the target year of our long-term management plan

Long term: until around 2040 in line with the vison of our long-term management plan

<Climate-related risks>

| Risk item | Business impact (risk) | Assessment (impact) |

Timing of the impact | ||

|---|---|---|---|---|---|

| Risks related to the transition to a lower-carbon economy | Policy and legal | Carbon tax | ・If a carbon tax is introduced, taxes levied on fuel will increase procurement costs, resulting in a rise in the costs of energy and raw materials. | Large | Medium to long term |

| Carbon border tax | ・If a carbon border tax is introduced, taxes will be levied on products to be exported, resulting in the reduction in the cost competitiveness of the products. | Large | Short to long term | ||

| Regulations on carbon emissions | ・The achievement of GHG reduction targets will be required, resulting in increases in the costs of, for example, making capital investments and purchasing electricity generated from renewable energy sources. | Large | Medium to long term | ||

| Sale of gasoline-powered vehicles | ・In countries that ban the sale of gasoline-powered vehicles, OEM demand will disappear, resulting in a decrease in sales. | Large | Medium to long term | ||

| Technology | Proliferation of energy-saving and renewable-energy technologies | ・The introduction of new energy-saving and renewable-energy technologies will increase the cost of, for example, making capital investments. | Medium to large | Short to long term | |

| Development of new technologies | ・Expenditures on the research and development of new technologies will increase. | Large | Short to long term | ||

| Market | Shift in customer preferences | ・After the 2030s, the number of people who choose ZEVs even as used cars will increase, resulting in a decline in demand for spark plug replacement and eventually a decrease in sales. ・Products that emit less CO2 in their life cycle will be chosen, resulting in a decrease in the sales of conventional products. |

Large | Long term | |

| Reputation | Shift in investor preferences | ・Investors’ opinions will turn against internal combustion engines, resulting in divestments. | Small to medium | Medium to long term | |

| Shifts in job-seekers’ preferences | ・Job seekers’ opinions will turn against internal combustion engines. Accordingly, job seekers will not choose us as their place to work. | Small to medium | Short to medium term | ||

| Risks related to the physical impacts of climate change | Acute | Increased severity of extreme weather events | ・Typhoons and other extreme weather events will cause damage to plants and other facilities, resulting in shutdown or a decrease in production. Furthermore, additional costs will be incurred to restore equipment. Non-life insurance premiums will also increase. | Small to medium | Short to long term |

| Chronic | Sea level rise | ・Rising sea levels will increase the risk of flooding and storm surges. Plants and transport infrastructure located in coastal areas will be damaged and supply chains will be broken, resulting in the extra costs of addressing these problems. | Small to medium | Long term | |

| Changes in precipitation patterns and variability in weather patterns | ・Plants in areas facing severe water shortage will be forced to shut or slow down operations due to limitations on water usage, resulting in the cost of shifting production to other plants, increased transportation costs and the like. | Small to medium | Long term | ||

| Rising mean temperatures | ・Employees who work in extreme heat will frequently get heat stroke. To reduce their increased physical burden, the cost of dealing with extreme heat and labor costs will increase. | Small to medium | Long term | ||

On the other hand, we also assessed the potential risk of future climate-related disasters, such as floods, droughts, and high tides, and found that there are regions where an increase in precipitation is anticipated. However, whether this increase directly leads to a higher risk of events like floods or landslides depends on the location of each business site (including factors such as ground conditions, elevation, and proximity to rivers) and the state of flood control measures. Therefore, we will continue to conduct further investigations.

<Climate-related opportunities>

| Aspect | Major opportunity | When opportunities present themselves |

|---|---|---|

| Resource efficiency | ・The increasing adoption of new energy-saving and renewable-energy technologies will reduce energy costs. | Medium to long term |

| Energy source | ・The increased demand for hydrogen as a fuel exempt from carbon tax will provide new opportunities in the hydrogen energy market. ・With the development of methanation and its relevant technologies, synthetic fuels like e-fuel will become more widely used, ensuring the continuity of our current internal combustion engine business. |

Long term |

| Products and services | ・To conform to fuel efficiency regulations, demand for high value-added products will increase. | Short to medium term |

| ・The hydrogen energy market is expected to grow due to mandatory reduction of GHG emissions. Increased demand for hydrogen technologies, SOFCs and SOECs will provide business opportunities. | Long term | |

| ・The demand for CO2 recycling solutions, such as producing hydrogen using electricity (SOEC) and utilizing recovered CO2 as fuel, will increase. | Long term | |

| ・In disaster preparedness, local consumption of locally-produced energy (distributed power generation) will receive attention, resulting in increased demand for SOFCs. | Long term | |

| ・The demand for ceramic-related technologies and products used in electric motors and generators will increase. | Medium to long term | |

| Markets | ・The development of new climate-related technologies that meet social needs will provide business opportunities. | Medium to long term |

| Resilience | ・In disaster preparedness, the continuous reinforcement of the BCM and BCP of our group, including our supply chain, will help enhance our resilience. | Short to long term |

To further clarify climate-related risks and opportunities, we examined business environments and responses by business type under both 2℃ and 4℃ scenarios.

As a result of our examination, no existential impact from physical risks has been identified.

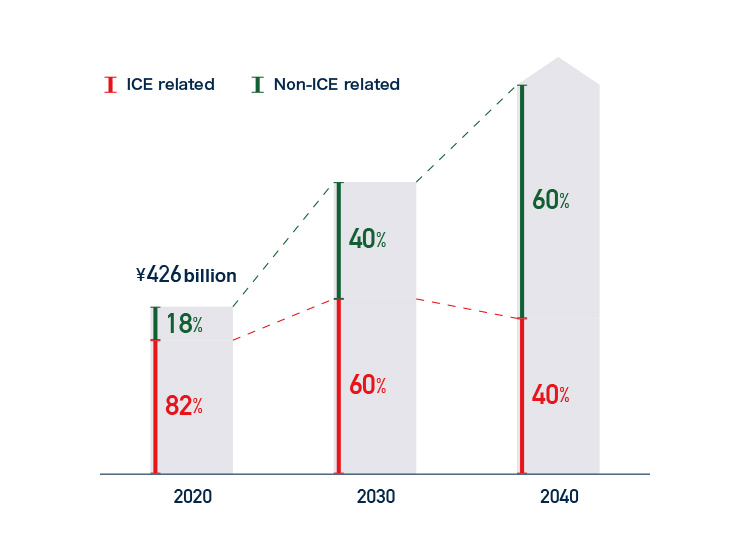

With regard to our business related to internal combustion engines, whose sales revenue makes up 80% of the total at present, we are facing a major change. On the other hand, geared toward the realization of a decarbonized society, hydrogen-related and other new needs and markets are expected to arise. Therefore, in the 2030 Long-Term Management Plan NITTOKU BX, we take up “Environment & Energy” as one of the business fields to focus on. Toward 2040, we will push forward with a business portfolio conversion (Revenue composition: 40% ICE related business, 60% non-ICE related business).

| Examined business | Product | Responses to future business risks and opportunities | Financial impact | Sales revenue target in our long-term management plan |

|---|---|---|---|---|

| Automotive related business | Spark plugs, glow plugs, sensors | Under the 2℃ scenario, sales of internal combustion engine parts are expected to decline in the future due to stricter regulations on vehicles with internal combustion engines. On the other hand, opportunities will arise in the electric vehicle market and other new markets. Under a 4℃ scenario, further energy conservation and toxic-gas-emission control will be required in terms of internal combustion engines. Therefore, we will take measures to improve the performance of internal combustion engines. |

Will affect a portion of our revenue*1 | 450 billion yen (FY2029) |

| Fuel cell business | Fuel cells | Under either a 2℃ or 4℃ scenario, demand for non-fossil energy sources is expected to grow. Therefore, we will continue to enhance our measures taken in the relevant markets. Under a 2℃ scenario, the proliferation of hydrogen infrastructure is expected. Therefore, the market may grow at an increasing rate. |

A market worth 200 billion yen is expected, with the possibility of more than that depending on the spread of hydrogen infrastructure. | 300 billion yen (FY2029) |

| Other businesses | SPE, packages, oxygen concentrators, bearing balls, etc. | Under either a 2℃ or 4℃ scenario, the impact on risks and opportunities is small. | The financial impact is small. |

Our group operates business globally and in various fields, which means that each business presents a range of risks and opportunities. Therefore, we assess risks and opportunities on a per-business basis and respond to each of them. With respect to climate change-related risks and opportunities, we strive to take appropriate measures while monitoring regulatory trends and evaluating their impact on our respective business operations.

The Risk Management Committee conducts risk assessment from a company-wide perspective in terms of whether or not the risk will have a great impact on our business continuity and goal achievement, by analyzing the level of impact, the probability of occurrence, and the status of countermeasures. Risks deemed to require special attention are identified as “priority risks,” and responsible departments are designated. The progress of activities to reduce these priority risks is monitored by the Risk Management Committee.

Risks related to ESG, including climate change and human rights, are also evaluated in conjunction with these efforts. Meanwhile, key opportunities are reviewed by the CSR and Sustainability Committee, and they are incorporated into our management strategy and Priority Management Issues, if necessary.

In our “2030 Long-Term Management Plan NITTOKU BX,” announced in May 2020, our group has set the goal of “CO2 Emissions: 30% Reduction [compared to FY2018] (by FY2030).”

Furthermore, to strengthen our environmental conservation efforts from a long-term perspective, we established “Eco Vision 2030” in April 2021, outlining our long-term objective of achieving carbon neutrality by 2050.

In “Eco Vision 2030,” we have identified four key priorities, namely climate change mitigation, the expansion of environmentally conscious products, conserving water resources, and waste management. The expansion of environmentally conscious products aims to provide products and services that contribute to environmental considerations, including climate change mitigation and CO2 reduction, such as Solid Oxide Fuel Cells (SOFC) and “Carbon Neutrality as a Service.” In addition, reducing water consumption for preserving water resources, as well as reducing resource input and waste output, also contribute to reducing CO2 emissions. Therefore, by setting these as the four key priorities and addressing them not as individual issues but as interconnected challenges, we aim to achieve more synergistic solutions.

To further drive efforts toward achieving these goals, we have introduced “CO2 Emission Reduction Rate” as a performance indicator in the performance-based stock compensation system for directors (excluding directors who serve on the audit committee and external directors) and executive officers (excluding executive officers on an employment contract). Additionally, to promote collective CO2 reduction initiatives across the group, we have implemented Internal Carbon Pricing (ICP).

We levy ¥10,000 per ton of CO2 emissions from emitting departments through ICP, and the collected funds are allocated to our internal environmental fund, which supports investments and infrastructure development for decarbonization.

We will also promote reductions in Scope 3 emissions, including those in the supply chain. As for Scope 3, our initial aim is to achieve a 30% reduction (compared to FY2018) by FY2030 in Category 1 “Purchased Products/Services,” partial elements of Category 4 “Upstream Transportation/Distribution,” and Category 11 “Use of Sold Products.” We also ask our business partners (suppliers) to set CO2 reduction targets and work towards these goals, providing support as needed.

<Targets and results of CO₂ emissions reduction>

| Item | Target | Result |

|---|---|---|

| Scopes 1 and 2 | 30% reduction by FY 2030 (Compared to that of FY 2018) |

31.7% reduction in FY 2023 (Compared to that of FY 2018) <Emissions: 191K tons> <Emission intensity: 0.49 tons/million yen> |

| Scope 3: Category 1 “Purchased goods and services” Category 4 “Upstream transportation and distribution” (in part) Category 11 “Use of sold products” |

30% reduction by FY 2030 (Compared to that of FY 2018) |

13.4% decrease in FY 2023 (Compared to that of FY 2018) <Emissions: 9.51 million tons> |